Last updated on December 27th, 2025 at 02:06 pm

If you’re planning to travel abroad from the Philippines, there’s one important expense you should be aware of: the Tourism Infrastructure and Enterprise Zone Authority (TIEZA) Travel Tax. Many travelers overlook this fee, only to be surprised at the airport. In this comprehensive 2025 guide by Arabian Vox, we’ll explain everything you need to know: how much the travel tax costs, who needs to pay it, who is exempt, and how to pay it. Stay informed and avoid last-minute surprises before your flight.

What is Travel Tax in the Philippines?

The Philippine Travel Tax is a government-imposed fee charged to individuals departing from the Philippines for international travel. This tax applies to all passengers, regardless of where their ticket was purchased or how it was paid for.

Legal Basis:

- Presidential Decree No. 1183 (PD 1183): This decree established the travel tax liability for Filipino citizens and certain foreign residents.

- Republic Act No. 9593 (Tourism Act of 2009): This law created the Tourism Infrastructure and Enterprise Zone Authority (TIEZA), which oversees the collection and management of travel tax revenues. See more finance topics in the Finance category.

Purpose of the Travel Tax:

The travel tax helps fund various national programs that promote tourism, education, and cultural development. The distribution of proceeds is as follows:

- 50% goes to TIEZA for tourism infrastructure and development projects

- 40% goes to the Commission on Higher Education (CHED) for educational programs in tourism and hospitality

- 10% goes to the National Commission for Culture and the Arts (NCCA) to support cultural preservation and promotion

In essence, while the travel tax may seem like just another expense, it actually contributes to enhancing the Philippines’ tourism ecosystem, supporting local education, and preserving cultural heritage. Travelers relocating to the UAE often look into UAE Tax Residency Certificate requirements.

How Much Is the Travel Tax in 2025?

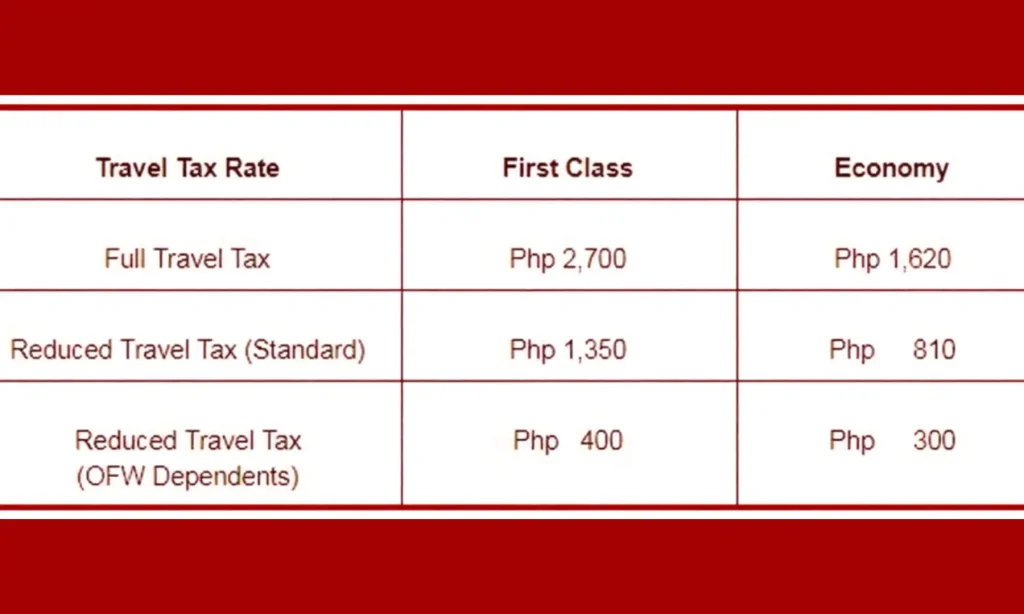

As of the most recent publicly-available TIEZA rates, here’s the matrix:

|

Tax Category |

First-Class / Business Class Passage |

Economy Class Passage |

|

Full Travel Tax |

PHP 2,700 |

PHP 1,620 |

|

Standard Reduced Travel Tax |

PHP 1,350 |

PHP 810 |

|

Privileged Reduced Travel Tax (for dependents of OFWs) |

PHP 400 |

PHP 300 |

Important Notes:

- The Full Travel Tax rate applies to most adult passengers, including Filipino citizens and certain foreign residents departing for international destinations.

- The Standard Reduced Travel Tax applies to specific categories such as minors or other qualified individuals, provided they have approved supporting documents.

- The Privileged Reduced Travel Tax is granted to the legitimate spouse or unmarried children of Overseas Filipino Workers (OFWs) who are traveling to the worker’s country of employment.

- Infants below 2 years old are fully exempt from paying the travel tax.

- These rates have remained unchanged for many years (since at least 1998, according to legal sources), but it is always best to verify the latest rates and policies on the official TIEZA website before traveling. If earning abroad, you may also need a Tax Identification Number (TIN) depending on residency rules.

Who Needs to Pay the Travel Tax?

Here’s a clear breakdown of who is required to pay the full travel tax and who may qualify for reduced or exempted rates:

Who Pays the Full Travel Tax:

- Filipino citizens departing the Philippines on an international flight.

- Foreign passport holders who are subject to the travel tax due to their residency or stay conditions in the Philippines.

- Non-immigrant foreign nationals who have stayed in the Philippines for more than one year prior to their departure. Some travelers compare Philippine rules with US tax rates.

Who Might Be Exempt or Pay a Reduced Travel Tax?

Not all travelers are required to pay the full Philippine travel tax. Certain individuals may qualify for exemptions or reduced rates, depending on their age, residency status, or relationship to an Overseas Filipino Worker (OFW).

Full Exemption

- Infants under 2 years old – Completely exempt from paying the travel tax.

Reduced Travel Tax Categories

- Dependents of OFWs – Eligible for the Privileged Reduced Rate (PHP 400 for economy class / PHP 300 for first class).

- Minors aged 2 to 11 years old – May qualify for the Standard Reduced Rate (e.g., PHP 810 for economy class), provided they have the required documentation. Earnings from abroad may fall under capital gains tax depending on residency.

Possible Exemptions for Specific Travelers

- Foreign tourists staying in the Philippines for less than one year – May be exempt, especially if not classified as residents.

- Diplomats, UN personnel, and official government travelers – Often exempt under specific international or government provisions.

Key Reminders

- Holding a foreign passport does not automatically mean exemption. If you are a permanent resident or a non-immigrant foreign national who has stayed in the Philippines for over one year, you are still subject to the travel tax.

- Airfare origin doesn’t affect tax obligation. Even if your ticket was purchased or issued abroad, you must still pay the travel tax if you are departing from a Philippine airport and belong to a taxable category.

How to Pay the Philippine Travel Tax

Paying the Philippine Travel Tax correctly is essential to avoid delays at the airport or during check-in. Whether you’re paying online or in person, following the proper steps ensures a smooth travel experience. Below is a complete, step-by-step guide! Including where you can add images for better illustration. Expats may also review UAE corporate tax basics when investing.

Step 1: Check if the Travel Tax is Already Included in Your Ticket

Before making any separate payment, review your e-ticket or booking confirmation. Many airlines already include the TIEZA travel tax in the total fare.

- Look for the “PH Travel Tax” or “TIEZA Fee” under the taxes and fees breakdown.

If it’s listed, you don’t need to pay again at the airport.

Step 2: Determine Your Tax Status

You must know whether you need to pay the full travel tax, a reduced rate, or if you are exempt.

Ask yourself:

- Am I a Filipino citizen, foreign resident, or OFW dependent?

- Do I qualify for a Travel Tax Exemption Certificate (TEC) or a Reduced Travel Tax (RTT) certificate from TIEZA?

If you are unsure, visit the official TIEZA website for the latest criteria and application details.

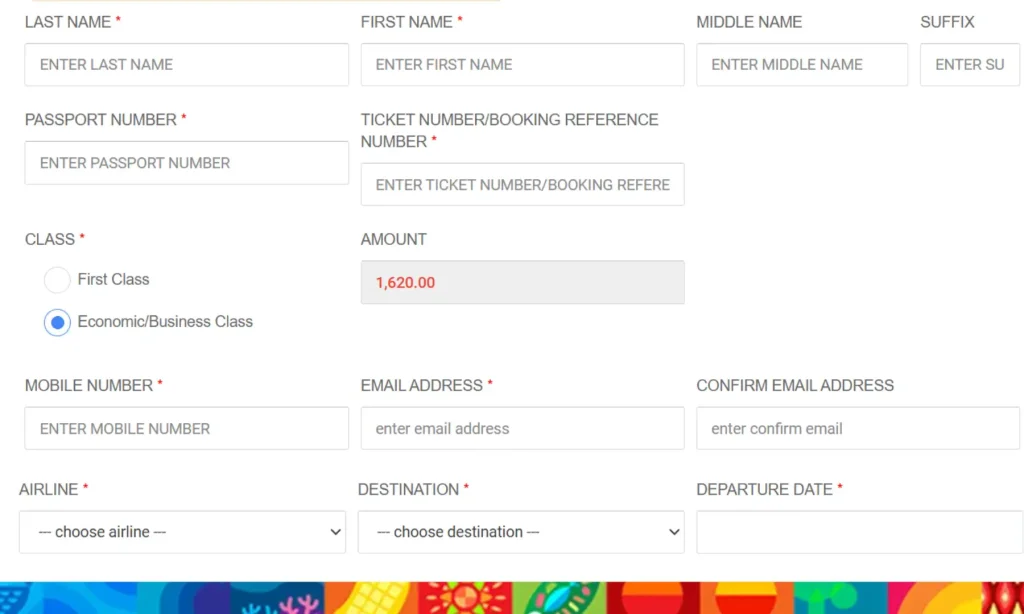

Step 3: Pay or Apply Online (Recommended)

TIEZA offers a convenient Online Travel Tax Services System (OTTSS) that allows travelers to pay or apply for exemption in advance.

How to pay online:

- Visit the TIEZA Online Travel Tax Services System (OTTSS).

- Enter required details such as:

- Full name

- Passport number

- Ticket number

- Departure date and destination

- Choose your payment method (credit/debit card or e-wallet).

- Complete the transaction and download the Acknowledgment Receipt.

- Print two copies — one for your records and one to present at check-in.

Step 4: Pay On-site (Airport or TIEZA Office)

If you’re unable to pay online or you need to process an exemption, you can do it in person.

You can pay at TIEZA counters located at major airports such as:

- Ninoy Aquino International Airport (Manila)

- Mactan-Cebu International Airport

- Clark International Airport

Bring the following documents:

- Original passport

- Flight ticket or booking confirmation

- Supporting documents (for reduced rate or exemption applications)

If you’ve already paid the full tax but later discover that you’re eligible for a reduced rate or exemption, you can apply for a refund at any on-site TIEZA office.

Step 5: During Airline Check-In

At check-in, present your payment receipt or TEC/RTT certificate to the airline staff.

- The airline will verify your travel tax status.

- Your boarding pass or e-ticket should display one of the following:

- “PAID” – Travel tax has been settled.

- “EXEMPT” – You hold a valid TEC.

- “RTT” – Reduced Travel Tax has been approved.

Why Paying the Travel Tax Properly Matters

Understanding and managing your Philippine travel tax before your trip can save you from unnecessary delays and inconvenience at the airport. Here’s why it’s important — and what every traveler should take note of:

Avoid Delays at the Airport

If your travel tax hasn’t been paid or your exemption certificate isn’t valid, you may not be allowed to check in until the issue is resolved. This can cause flight delays or even missed departures.

Check Your Ticket Carefully

Always review the fees and taxes section of your e-ticket. Look for labels like “XT/PH” (indicating Philippine travel tax). If unsure, ask your airline whether the travel tax is already included in your fare.

Plan Ahead for Online Payment

Using TIEZA’s Online Travel Tax Services System (OTTSS) is the fastest and most convenient way to pay. This reduces the risk of waiting in long lines at airport counters.

Keep All Travel Documents

Always keep copies of your receipts, TEC/RTT certificates, and proof of eligibility. These are useful if you need to request a refund or clarify your tax status later.

Know the Exemptions

If you qualify for a reduced tax or full exemption, prepare all required supporting documents early. Some exemptions, such as those for OFW dependents or scholars, require prior approval.

Double-Check Special Cases

Certain travelers — like Overseas Filipino Workers (OFWs), diplomats, scholarship grantees, or long-term foreign residents — may have unique travel tax classifications. Always confirm your category before departure.

Step-by-Step Checklist for Travelers

Follow this simple checklist to ensure your travel tax process is smooth and hassle-free:

- Check your ticket – Confirm whether the travel tax is already included in your fare.

- Determine your liability – Identify if you’re subject to the full tax, a reduced rate, or exemption.

- Gather documentation – Prepare your passport, flight ticket, and supporting proof (OFW ID, scholarship documents, etc.).

- Pay or apply before departure – Use TIEZA’s OTTSS online platform or pay directly at the airport/TIEZA office.

- Obtain and carry your receipt or certificate – Print at least two copies of your acknowledgment receipt and bring the original for check-in.

- At check-in – Present your receipt or TEC/RTT certificate to the airline staff. Ensure your ticket or boarding pass shows the payment or exemption status.

- After your flight (if needed) – If you discover you overpaid or qualified for an exemption, file a refund request at a TIEZA office with the necessary documents.

FAQs

Is the travel tax the same as the terminal fee?

No. The travel tax is imposed by TIEZA, while the terminal fee is a separate airport charge.

What if my flight is cancelled or I don’t depart?

You can apply for a refund if you didn’t travel or paid the full tax despite being eligible for a reduced rate or exemption.

What about dual citizens or Filipinos living abroad?

Dual citizens must still pay unless they qualify for an exemption. Residency abroad doesn’t automatically exempt you.

What about children, students, and senior citizens?

- Infants below 2 years: Exempt.

- Children 2–11 years: Reduced rate if qualified.

- Senior citizens: No automatic exemption.

- Students on official scholarships: May qualify for exemption or reduced rate.

What if my ticket was issued outside the Philippines?

You still need to pay if you’re departing from the Philippines, regardless of where the ticket was issued.