Last updated on December 27th, 2025 at 02:12 pm

The UAE’s business scene has entered a new chapter with the rollout of the 9% federal corporate tax, marking one of the biggest shifts in the country’s financial history. If your company earns more than AED 375,000 in taxable income, corporate tax registration isn’t optional! It’s a legal requirement.

But here’s the good news: registering is simpler than you think. Through the EmaraTax portal, businesses can complete the process online in just a few steps. In this comprehensive 2025 guide, Arabian Vox breaks down everything you need to know! Who must register, what documents you’ll need, how to apply, and how to stay compliant after registration.

Whether you’re a new entrepreneur or managing an established firm, this article will help you understand, register, and manage corporate tax in the UAE with total confidence.

Understanding Corporate Tax in the UAE

What Is Corporate Tax and Why Was It Introduced?

Corporate tax is a government-imposed tax on the profits earned by companies and businesses. The UAE introduced it to align with international standards, increase financial transparency, and strengthen its position as a global business hub. The goal is to support long-term economic growth while ensuring businesses contribute fairly to national development. Many companies also need to know what a Tax Identification Number (TIN) is, since it’s often required for tax registration.

Who Needs to Pay Corporate Tax?

Corporate tax applies to all UAE-registered companies, including mainland and free zone entities, that generate taxable income. Natural persons conducting business activities under a trade license may also fall under this category. However, certain entities! Like government bodies, qualifying public benefit organizations, and some investment funds! May be exempt.

What Is the Standard Tax Rate in the UAE?

The standard corporate tax rate in the UAE is 9% on taxable profits above AED 375,000, while income up to that amount is taxed at 0%. This structure is designed to support small and medium businesses while keeping the UAE attractive for investors and entrepreneurs.

What Makes the UAE’s Corporate Tax System Unique?

Unlike many countries, the UAE’s corporate tax regime is straightforward and business-friendly. It offers clear rules, competitive rates, and exemptions for qualifying free zone companies. Combined with the absence of a personal income tax, the UAE remains one of the most attractive destinations for global businesses. If your business deals with cross-border payments, you should also learn how withholding tax works in the UAE.

Are You Eligible for Registration?

Businesses That Must Register for Corporate Tax

Under the UAE’s corporate tax regime, registration is mandatory for all “Taxable Persons.” This means that even if a business is not yet making profits, or is structured in a free zone, it must still register and obtain a Corporate Tax Registration Number (TRN).

Key categories include:

- Companies incorporated in the UAE! Whether on the mainland or in a free zone.

- Foreign entities that conduct business or have a permanent establishment in the UAE.

- Natural persons (individuals) who conduct a business or business activity in the UAE and whose total turnover exceeds the prescribed threshold.

Even if the business is making losses or has zero profit, the registration requirement still applies.

Who Is Exempt from Corporate Tax?

Not all entities have a corporate tax liability or the standard registration obligations. Some categories are considered “Exempt Persons” under the law and may not have to pay the tax or even register (unless requested by the authority).

Examples of exempt persons are:

- Certain government entities or government-controlled entities specified in a cabinet decision.

- Qualifying public benefit entities, pension or social security funds, and certain investment funds when they meet specified conditions.

However, it’s important to note that exemption from tax does not always mean exemption from registration. The authority may require even Exempt Persons to register for administrative purposes.

Free Zone Companies – The 0 % Corporate Tax Advantage

Companies operating in UAE free zones can benefit from a highly attractive tax position — but only if they meet specific criteria under the “Qualifying Free Zone Person” (QFZP) regime. Some companies may also need to get a Tax Residency Certificate in the UAE for compliance or tax treaty benefits.

Key points:

- A Free Zone Person is a legal entity incorporated or registered in a designated free zone for corporate tax purposes.

- To enjoy the 0% tax rate on Qualifying Income, the entity must meet certain conditions: maintaining adequate substance in the UAE, deriving qualifying income, and not making the election to be taxed under the standard rate.

- If the entity fails to meet those criteria (e.g., earns non-qualifying income, does business directly with the mainland, lacks sufficient substance), then the standard tax regime applies! Meaning 9% on taxable income above AED 375,000.

Thus, free-zone entities must still register and continuously monitor compliance to retain the benefit.

What’s the Difference between Natural Persons and Juridical Persons?

In the UAE corporate tax context:

- Juridical persons refer to legal entities such as companies, partnerships, free zone entities, branches, etc. These are the traditional “corporate” taxpayers under the law.

- Natural persons mean individuals (persons) who conduct business or business activities under a trade license or similar in the UAE.

For natural persons:

- They become taxable (and must register) when their business turnover exceeds AED 1 million in a calendar year for business activities.

- Employment income (salary, wages) or purely passive investment income is generally out of scope for corporate tax.

For juridical persons:

- Registration is mandatory regardless of tax liability or profitability (subject to being a “taxable person” under the law).

Documents You’ll Need for Corporate Tax Registration

Essential Documents Checklist

When registering for corporate tax in the UAE via the Federal Tax Authority (FTA) portal, businesses must upload a set of key documents. According to the official registration page, for legal persons, the application must include at least the trade licence, identification of the authorised signatory, and proof of authorisation for that signatory. Investors should also understand what capital gains tax means when assessing their tax obligations.

Here’s a fuller checklist:

- Valid trade licence (mainland or free-zone) showing current business activities.

- Emirates ID or passport copy of the authorised signatory or owner(s).

- Memorandum of Association (MOA) or Articles of Association (AOA) showing company structure, where applicable.

- Official company contact information: registered address, PO Box, email and telephone.

- Valid bank account details or corporate bank IBAN (for some applications) and proof of account may be required.

- If registering via an agent or power of attorney, a duly executed Power of Attorney document is required to authorise the agent.

Tips to Avoid Delays During Submission

To ensure smooth registration and avoid unnecessary delays or rejection, consider these preparation tips:

- Ensure all licenses are valid and up-to-date. An expired or pending renewal trade licence may delay approval.

- Double-check that the identification documents match exactly with the applicant’s details on the portal (name spelling, ID numbers, expiry dates). Mismatches are frequent causes of delay.

- Fill in your business activity details accurately as per what is shown on your trade licence. Inaccurate or vague descriptions may trigger a review or additional information request.

- Upload the documents in the correct formats and within size limits. The FTA notes in its registry that accepted file types are PDF or Word and that individual file size limits apply.

- Keep scanned files clean and legible. Blurred scans, missing signatures or incomplete documents can cause the application to be paused for the request of further information.

- Submit early! Even if you may not yet have taxable income, registration is required, and the timeline matters. Delays may trigger penalties. Explore more UAE finance and tax guides in the Finance category.

Step-by-Step Guide to Register for Corporate Tax in EmaraTax

Step 1: Visit the EmaraTax Portal

Begin by going to the official online platform operated by the Federal Tax Authority (FTA). You can access it via eservices.tax.gov.ae.

This portal is your starting point for the entire registration process.

Step 2: Log In or Create an EmaraTax Account

- If you already have an account (for VAT or other FTA services), log in using your credentials.

- If you’re a new user, click “Sign Up” or “Register”, provide your email address, mobile number and follow the prompts to create an account.

The portal supports login via UAE PASS for quicker access. Find more expert resources on Arabian Vox.

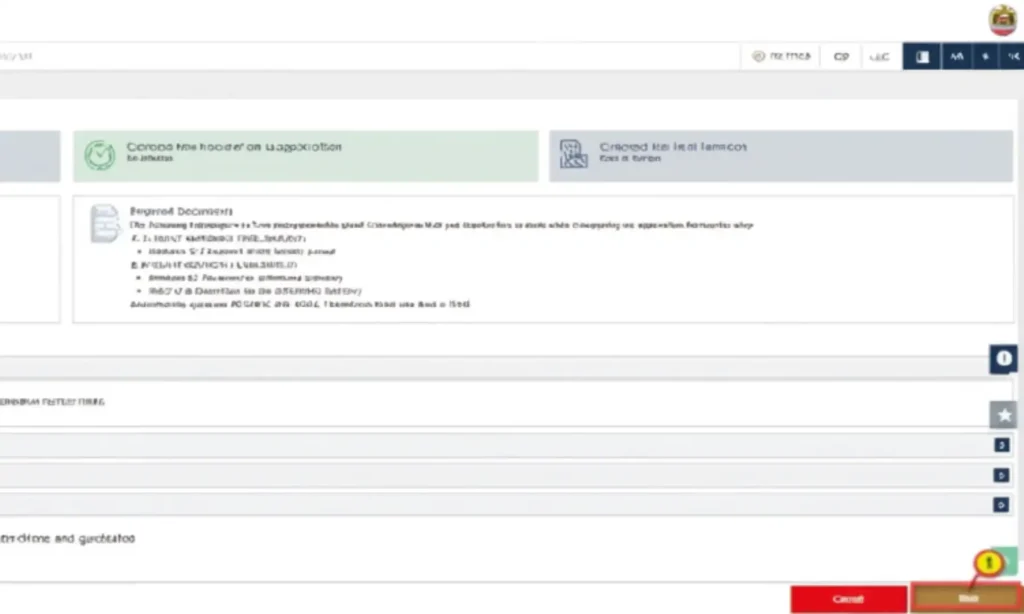

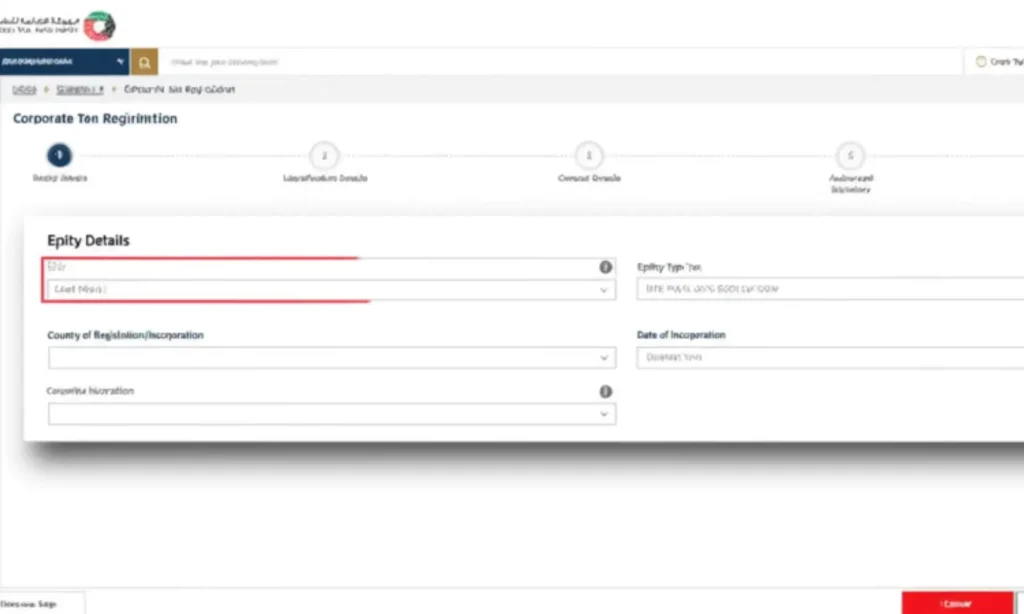

Step 3: Choose “Corporate Tax” as the Tax Type

Once you are logged in:

- Navigate to your Taxable Person Dashboard.

- If you do not see your business listed, click “Create Taxable Person” to add your entity profile.

On the dashboard, find the option labelled “Corporate Tax – Register” (or similar) and click to begin the registration application.

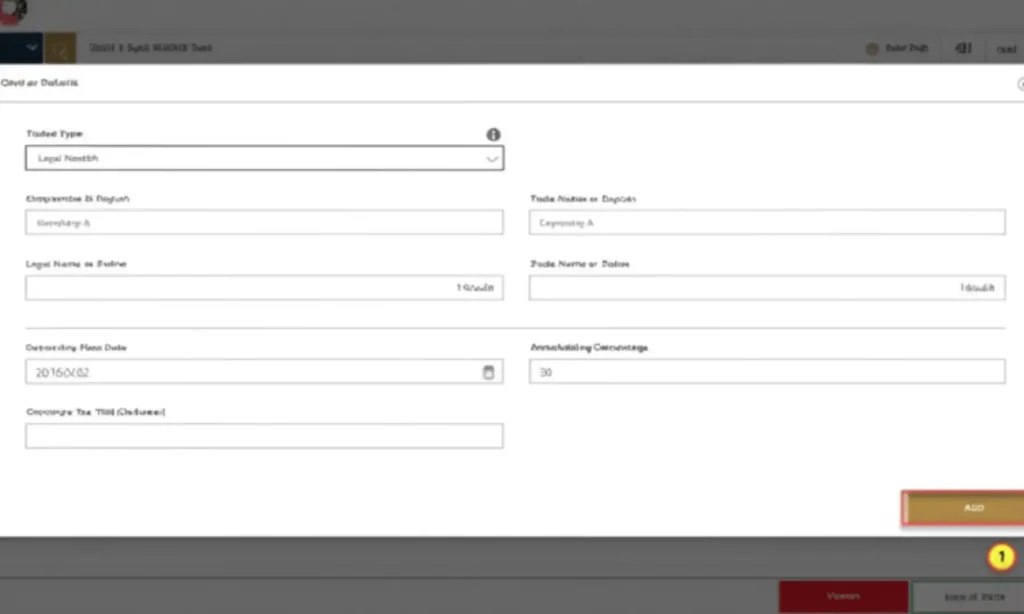

Step 4: Fill Out Business and License Details

You will be prompted to complete several sections of the application. These typically include:

- Entity Type & Subtype (for example, Mainland company, Free Zone entity, branch, etc)

- Trade Licence Details: licence number, issue/expiry dates, issuing authority.

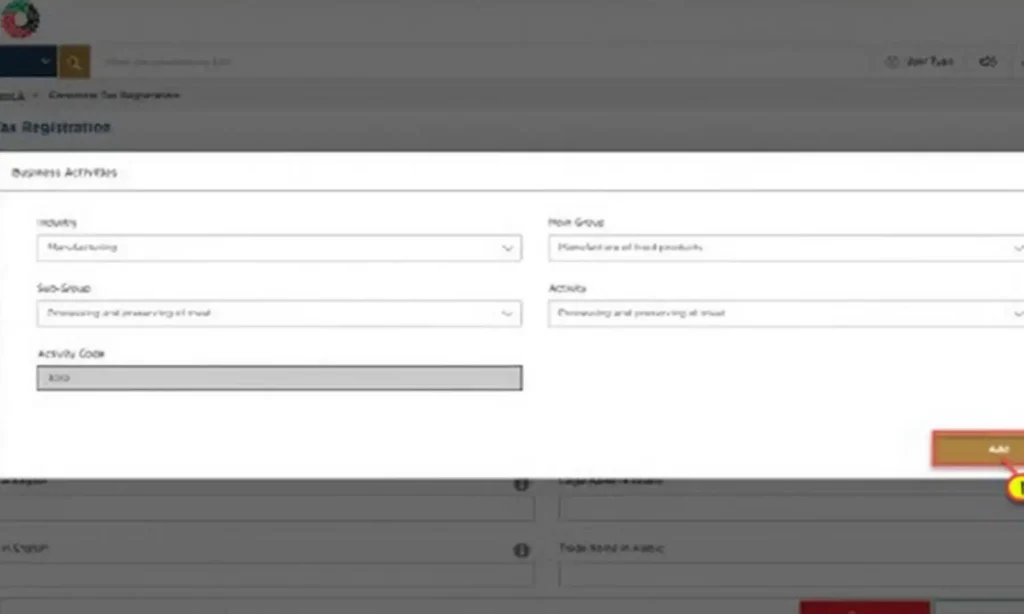

- Business activities: Add each activity stated on your trade licence; you may have to “Add” each one.

- Financial year / Tax period for your business.

If applicable: Branch details – whether you have branches, and their licence details.

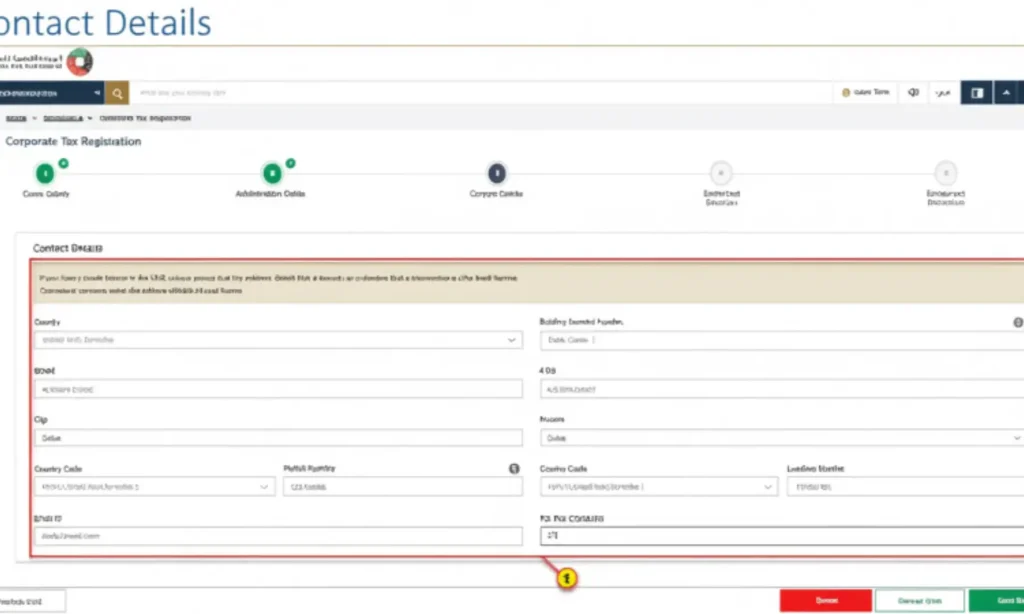

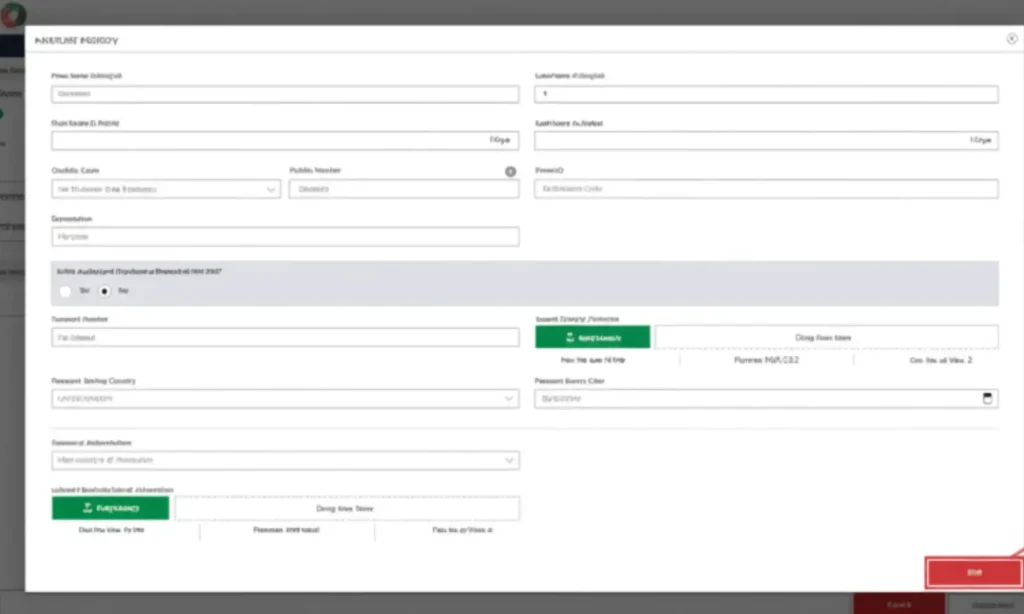

Step 5: Add Owner, Contact, and Authorized Signatory Information

- Enter details of all owners with 25 % or more shareholding (name, ID/passport, ownership percentage) if required.

- Provide the registered business address, PO Box, email and phone number! Make sure this matches the address on the trade licence and is not a third-party address.

Add the Authorized Signatory details – the person authorised to act on behalf of the business. Upload proof of authorization (e.g., Power of Attorney, board resolution) where needed.

Step 6: Review, Confirm, and Submit Your Application

- Before submitting, review every section thoroughly: ensure spelling, licence numbers, names and dates are all correct. Minor errors often cause delays.

- You can save your application as a draft and come back later if needed.

Tick the declaration box, submit the application and note the Reference Number you are issued upon submission – this will help track your case.

Step 7: Get Your Corporate Tax Registration Number (TRN)

- After submission the FTA will review your application. They may approve it, or request additional details.

- Once approved you receive your Corporate Tax Registration Number (TRN) and certificate. You will then be officially registered under the corporate tax regime.

- At this point you should start fulfilling post-registration obligations such as keeping records, filing returns and paying tax as required.

What Happens After You Register

Receiving Your TRN Confirmation

Once you’ve submitted your corporate tax registration through the EmaraTax portal, the Federal Tax Authority (FTA) reviews your application. If everything is correct and all documents are verified, you’ll receive your Corporate Tax Registration Number (TRN) via your registered email or within your EmaraTax dashboard.

This TRN serves as your official tax identity in the UAE — it’s required for filing returns, communicating with the FTA, and maintaining compliance. You’ll also be issued a Corporate Tax Registration Certificate, which you should download and keep for official and audit purposes.

Post-Registration Obligations: Filing & Record Keeping

Registering is just the beginning. Once your business has a TRN, you must comply with ongoing corporate tax obligations as outlined by the FTA. These include:

- Filing Annual Corporate Tax Returns:

Every taxable business must submit a corporate tax return within nine months after the end of its financial year. For example, if your financial year ends on 31 December 2024, your first return is due by 30 September 2025. - Maintaining Proper Accounting Records:

Companies must keep all accounting records, financial statements, and relevant documentation for at least seven years after the end of the tax period. This includes invoices, contracts, and audit reports to support all transactions and tax calculations. - Staying Audit-Ready:

The FTA can request documentation or conduct audits at any time to verify compliance. Keeping digital records through accounting software or FTA-approved systems helps you stay ready and avoid penalties.

When and How to Pay Corporate Tax

Corporate tax payments are due within the same nine-month window after the end of your financial year! The same deadline as your return submission.

How to Pay:

- Log in to your EmaraTax account.

- Select the Corporate Tax section and view your payment amount.

- Pay using one of the available methods:

- UAE eDirham Card

- Debit/Credit Card

- Bank transfer via GIBAN (Generated IBAN)

Late payments or missed filings can lead to penalties. According to the FTA, fines can range from AED 500 to AED 10,000, depending on the violation and duration of delay.

Timely filing and payment not only prevent penalties but also maintain your company’s compliance status! A key requirement for smooth operations and future government dealings.

Common Mistakes to Avoid During Corporate Tax Registration in the UAE

While registering for corporate tax through EmaraTax is straightforward, even small errors can lead to rejections, delays, or financial penalties. Here are the most common mistakes businesses make! And how you can avoid them.

1. Submitting Incomplete or Inaccurate Information

A single mismatch in your company’s details can trigger verification issues. Double-check that your trade name, license number, and legal entity type exactly match what appears on your trade license and other official documents. Always review your entries carefully before submission.

2. Using an Expired or Outdated Trade License

The FTA requires that your trade license be valid at the time of registration. Submitting with an expired license will automatically halt your application. Renew your license through the Department of Economic Development (DED) or your Free Zone Authority before proceeding.

3. Missing Required Supporting Documents

Applications missing key files are often rejected. You must upload all mandatory documents, including:

- Valid Trade License(s)

- Memorandum of Association (MoA) or Articles of Association

- Passport and Emirates ID of the authorized signatory

- Authorization proof, such as a Power of Attorney or board resolution

Make sure all files are clear, up-to-date, and, when required, translated into Arabic.

4. Incorrect Business Activity Details

When you declare your business activity in EmaraTax, it must match exactly what’s listed on your trade license. Choosing the wrong activity code can lead to compliance issues when filing your corporate tax returns later.

5. Ignoring Free Zone Requirements

Free Zone businesses enjoy special tax benefits! But only if they qualify under the “Qualifying Free Zone Person (QFZP)” criteria. Failing to declare Free Zone status or omitting required supporting details can cause you to lose your 0% corporate tax benefit.

6. Missing Registration Deadlines

The Federal Tax Authority has assigned specific registration deadlines based on your trade license issuance month. Missing these deadlines can lead to a penalty of AED 10,000 under Cabinet Decision No. 75 of 2023. Set reminders and file well before the cutoff.

7. Entering the Wrong Legal or Contact Information

Errors in your legal name, incorporation date, or address can result in your application being flagged for review. Use your actual business address! Not your accountant’s office or a PO box, to ensure smooth verification.

8. Ignoring Language and Document Format Rules

While most documents can be submitted in English, some! Such as Power of Attorney or MoA! May require an official Arabic translation. Always verify document format requirements to avoid FTA resubmission requests.

9. Submitting Without Proper Authorization

Only an authorized signatory can legally submit your corporate tax registration. Ensure you attach valid authorization proof (like a board resolution or notarized Power of Attorney) with your application.

10. Rushing the Process Without Review

A quick submission might save a few minutes now, but it can cost days in correction delays. Use the “Save as Draft” feature on the EmaraTax portal, review your data thoroughly, and confirm all details before hitting submit.

Corporate Tax Deadlines and Compliance Guidelines

Understanding Registration Deadlines

The registration deadline for UAE Corporate Tax is determined by the issue date of your trade license, not by your company’s financial year. Missing your registration date can lead to penalties of AED 10,000 as per Cabinet Decision No. 75 of 2023.

|

Trade License Issue Month |

Registration Deadline |

Late Penalty |

|

January – February |

31 May 2024 |

AED 10,000 |

|

March – April |

30 June 2024 |

AED 10,000 |

|

May |

31 July 2024 |

AED 10,000 |

|

June |

31 August 2024 |

AED 10,000 |

|

July |

30 September 2024 |

AED 10,000 |

|

August |

31 October 2024 |

AED 10,000 |

|

September |

30 November 2024 |

AED 10,000 |

|

October |

31 December 2024 |

AED 10,000 |

|

November |

31 January 2025 |

AED 10,000 |

|

December |

28 February 2025 |

AED 10,000 |

If your business holds multiple trade licenses under one legal entity, the earliest license issuance date determines your registration deadline.

Filing and Compliance Requirements

- Corporate Tax Filing Deadline

Businesses are required to file their first corporate tax return within nine months from the end of their financial year. - Record-Keeping Obligations

Maintain accurate financial statements, invoices, contracts, and all supporting documents for at least seven years to comply with FTA requirements. - Accuracy and Transparency

Ensure all declared income, expenses, and activities are truthful and well-documented to avoid discrepancies during FTA audits. - Continuous Compliance

Regularly review your company’s structure, financial activities, and documentation to stay aligned with UAE Corporate Tax regulations. - How to Avoid Penalties

- Register before your assigned deadline

- Double-check all business details before submission

- Keep updated on any FTA rule changes

- Seek advice from a certified tax consultant when needed

Deregistration – When and How to Cancel Your Corporate Tax Registration

Businesses that stop operating or no longer fall under the scope of corporate tax must formally deregister with the Federal Tax Authority (FTA). Deregistration ensures that you are no longer liable for tax filing or payments and helps prevent penalties for non-compliance.

Who Can Apply for Deregistration

You can apply for corporate tax deregistration through the EmaraTax portal if your business falls under any of the following categories:

- Ceased Operations: The company has permanently stopped carrying out business activities in the UAE.

- No Longer Taxable: The business no longer meets the taxable income threshold or qualifies for corporate tax liability.

- Liquidation or Dissolution: Entities that have completed the liquidation process or have been legally dissolved.

- Exempt Entities: Certain organizations that are granted full exemption status under UAE tax law may also apply for deregistration.

Steps for Deregistration in EmaraTax

- Log In to the EmaraTax Portal

Access your account on EmaraTax using your UAE Pass or existing credentials. - Submit Deregistration Request

Navigate to the Corporate Tax section and select “Deregistration.” Fill out the deregistration form, providing accurate business and license details. - Attach Required Documents

Upload supporting documents such as liquidation certificates, trade license cancellation from the relevant authority, or proof of exemption. - Settle Outstanding Tax Obligations

Before deregistration, ensure that all pending tax returns are filed and any outstanding payments are cleared with the FTA. - FTA Review and Confirmation

The FTA will review your application and supporting documents. Once approved, you will receive a confirmation of deregistration via the EmaraTax portal.

Important: Even after deregistration, businesses must retain all accounting and tax records for a minimum of seven years as per FTA regulations.

Failure to deregister after closing or liquidating your company can result in administrative penalties, and the FTA may initiate an audit before approving deregistration.

Pro Tips – How to Prepare Your Business for Corporate Tax Compliance

Preparing for corporate tax compliance in the UAE requires more than just registration. It’s about maintaining transparency, accuracy, and readiness for audits throughout the year. Here are some expert tips to help your business stay fully compliant with FTA regulations.

1. Keep Financial Records in Order

Accurate record-keeping is the foundation of corporate tax compliance. The Federal Tax Authority (FTA) requires businesses to maintain financial statements and supporting documents for at least seven years.

Make sure to:

- Maintain income statements, balance sheets, invoices, and receipts.

- Store contracts, bank statements, and payment proofs for every transaction.

- Use accounting software or professional bookkeeping services to avoid manual errors.

- Ensure your records are easily accessible in case of an FTA audit.

Tip: Regularly reconcile your financial data to detect inconsistencies early and prevent compliance issues.

2. Understand Taxable Income Adjustments

Your accounting profit and your taxable profit are not always the same. The UAE Corporate Tax Law outlines specific adjustments that businesses must make to determine taxable income.

Key adjustments include:

- Non-deductible expenses: Fines, penalties, and certain entertainment costs cannot be deducted.

- Exempt income: Dividends from qualifying shareholdings and capital gains on qualifying assets may be exempt.

- Depreciation and amortization: Follow FTA-approved methods for asset depreciation.

Tip: Consult a certified tax advisor or use automated tax software to calculate adjustments correctly and avoid underpayment or overpayment of tax.

3. Regularly Check FTA & MoF Updates

The Federal Tax Authority (FTA) and Ministry of Finance (MoF) regularly publish updates, clarifications, and new guides on corporate tax laws, filing procedures, and compliance requirements.

Stay informed by:

- Visiting official websites: www.tax.gov.ae and www.mof.gov.ae.

- Subscribing to FTA newsletters or updates.

- Following trusted financial news sources for regulatory changes.

Tip: Always verify tax-related information from official FTA and MoF sources to avoid outdated or misleading advice.

How Arabian Vox Helps You Stay Tax-Smart from Day One

Corporate tax registration in the UAE isn’t just a one-time step! It’s about staying accurate, compliant, and audit-ready throughout your business journey. That’s where Arabian Vox steps in.

Verified Information

Every guide we publish is based on official sources like the UAE Ministry of Finance and Federal Tax Authority! No rumours, no confusion.

Simple Explanations

We break down complex tax regulations into clear, easy-to-follow language so businesses can understand without legal jargon.

Real-Time Updates

From new corporate tax deadlines to exemption clarifications, Arabian Vox keeps you updated so you never miss a compliance change.

With Arabian Vox, businesses don’t just register. They stay informed, compliant, and confident.

FAQs

Who Needs to Register for Corporate Tax in the UAE?

Businesses with taxable income above AED 375,000, including mainland companies, Free Zone entities, and certain non-residents.

Is Corporate Tax the Same for Free Zone Companies?

Qualifying Free Zone companies may pay 0% on qualifying income; others follow the standard rules.

What Is the Corporate Tax Rate in 2025?

9% on income above AED 375,000; 0% on income up to AED 375,000.

How Long Does the Registration Process Take?

Typically a few days if all documents and information are correct.

What If I Don’t Register for Corporate Tax?

You may face fines up to AED 10,000 and possible audits from the FTA.